Carbon Pricing: Carbon Markets and Carbon Taxes

Graham Diedrich, FCCP graduate research assistant, has written an overview discussing carbon pricing mechanisms titled, "Carbon Pricing: Carbon Markets and Carbon Taxes."

Carbon Pricing: Carbon Markets and Carbon Taxes

By Graham Diedrich, Michigan State University Forest Carbon and Climate Program

Overview

Carbon pricing is a mechanism to capture external costs and impacts of greenhouse gas (GHG) emissions by adding an extra cost to the use of the fossil fuels. It ties damages associated with emissions (e.g., pollution, negative health repercussions) to the sources by putting a price on the carbon dioxide (CO2) emitted.1 This often includes other greenhouse gases as well, which are calculated and referenced as their carbon dioxide equivalent (CO2-e).

In general, there are two main approaches to carbon pricing: carbon trading markets and carbon taxes. Both mechanisms seek to reduce GHG emissions and shift companies, corporations, governments, and individuals towards low-emission alternatives.

Carbon Markets

A carbon market is a popular phrase used to describe any trading system through which countries, companies, individuals, and other entities may buy or sell units of greenhouse-gas emissions to meet their required or voluntary emissions limits.2 Carbon offsetting, the process by which entities account for emissions by purchasing calculated and third-party verified reductions elsewhere, is central to carbon markets’ functioning and trading of credits.3 Such offsets are designed, verified, and marketed in two ways: compliance or voluntary. Compliance markets are created and regulated by mandatory national, regional, or international carbon reduction programs, and are generally referred to as cap-and-trade markets or emission trading systems (ETS) in which actors are provided an allowance based on the emissions target set. Each actor will be incentivized to produce less than or equal to the GHG emissions target or cap, in theory reducing overall emissions from that sector. Compliance markets are considered an economically oriented strategy as the business can make decisions about when how to invest in new technology and other advancements to reduce emissions, recognizing that the costs of continuing to emit will increase over time as the cap tightens.

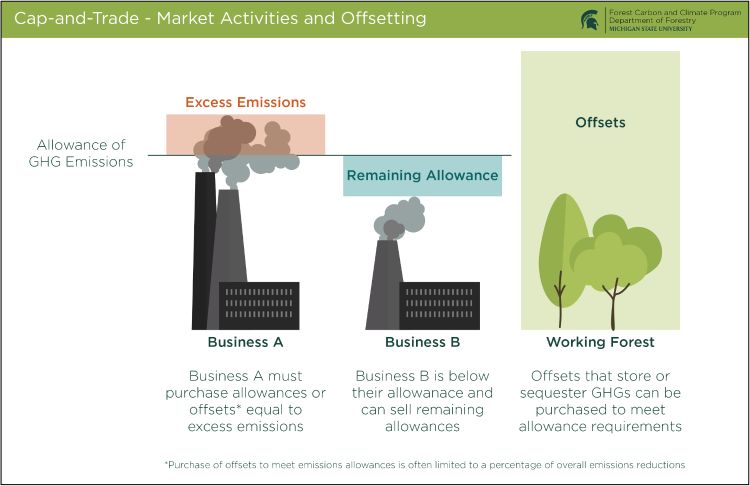

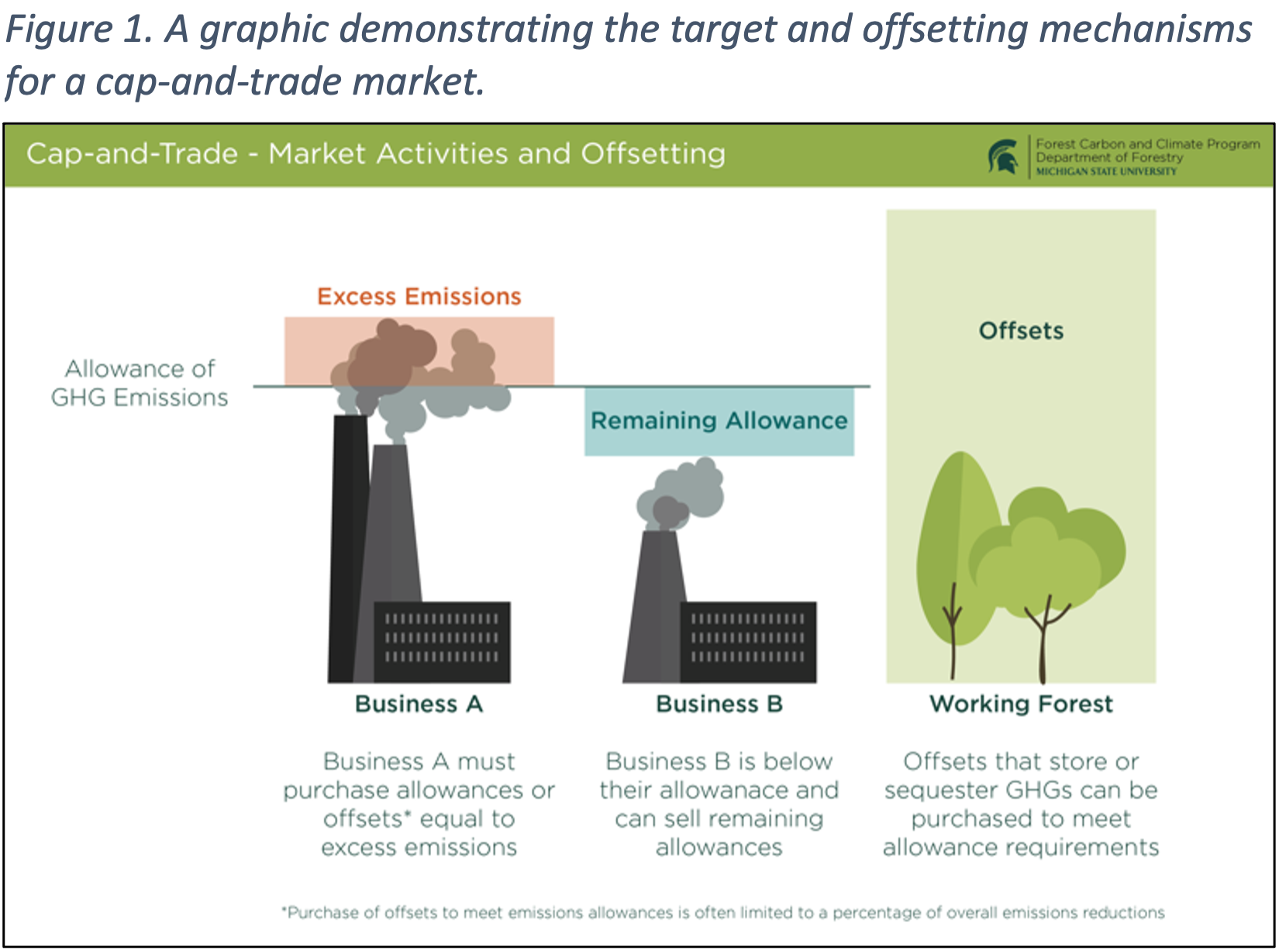

A depiction of cap-and-trade market is shown in Figure 1, where a mandated allowance of GHG emissions is set by the market’s governing institution. In this example, Business A has excess emissions beyond the emissions cap which means it must purchase allowances or offsets equal to the excess emissions to comply with the enforced limit. Thus, Business A has two choices: buy allowances from Business B or offset their emissions by storing or sequestering carbon elsewhere. Business B is below their allowances and therefore can sell remaining allowances to Business A. As of April 2021, ten national or regional ETS systems exist worldwide.3

Similar to compliance markets, voluntary carbon markets (VCMs) seek to have emissions at or below a specific target: often a sustainability target agreed upon by a company or group of companies representing a specific industry. However, voluntary markets do not have viable enforcement mechanisms to ensure members do not emit past agreed-upon limits. As shown in Figure 2, an entity that produces beyond their target has two choices. It can either offset emissions elsewhere and remain in compliance with their self-enforced target, or it can become noncompliant. This is because instead of enforceable punishments, VCMs are driven by a variety of considerations related to corporate social responsibility, ethics, and reputational or supply chain risk. It is worth noting that it cannot be assumed that such offsets are a net reduction in emissions, as an entity can simultaneously increase its GHG emissions while offsetting those emissions.

Criticisms of Carbon Markets

Compliance and voluntary carbon markets have both been criticized. Opponents of cap-and-trade state that it could lead to an overproduction of pollutants up to the maximum levels set by the government each year, and that it allows companies to pay a relatively small amount of money in order to pollute.4 Specifically, the European Union EST is often cited as having weak emissions caps, volatility in emissions allowance prices, and overly generous allocations of emissions allowances to regulated entities.5 Often times these critics point to another carbon pricing mechanism: carbon taxing.

Carbon Taxes

A carbon tax is a policy in which the government sets a price that emitters must pay for each ton of greenhouse gases they emit.6 The key objective is to incentivize businesses, consumers, and other actors to reduce their emissions to avoid paying the tax.

Carbon taxes can be categorized as either an emissions tax or a goods tax. An emissions tax is tax based on the quantity of CO2 an entity produces, while a goods tax focuses on goods or services that are generally GHG-intensive, like the gasoline and airline industry.6 Some similarities are shared between carbon taxes and compliance carbon markets. Both place a price on carbon, take advantage of market efficiencies, generate revenue, impose a compliance obligation on a limited number of firms, and require monitoring, reporting and verification.7

Criticisms of Carbon Taxes

Like carbon markets, carbon taxes are also criticized. Some believe that such taxes place burdens on low-income populations, as they are required to spend more relative to those with higher incomes from goods and services that have fossil fuel costs built into their prices. To address the regressive nature of carbon taxes, industry leaders have called for the addition of rebates or dividends for low-income households.8 The other main criticism with taxes is that they do not guarantee emissions reductions. Companies and other entities that can afford to pay the taxes will continue to emit, or economic growth generally will override the effect of the carbon tax.

Conclusion

Carbon pricing is an umbrella term used to describe policies that a place a price on CO2 emissions in order to change behaviors and decrease total emissions. Two main approaches to carbon pricing are carbon markets and carbon taxes.

Carbon markets describe the trading system through which countries, companies, individuals, and other entities may buy or sell units of greenhouse-gas emissions in an effort to meet their limits on emissions. There are two types of carbon markets: compliance and voluntary markets.

A carbon tax is a policy in which the government sets a price for each ton of CO2-e emitted. In general, there are two approaches to carbon taxation, one with a focus on pure emissions and another focusing on goods and services.

Importance differences exist between the two tactics. Most notable is the approach carbon markets and carbon taxes take towards cost certainty and environmental certainty. By the allowances limit, a cap-and-trade system achieves an environmental goal, but the cost of reaching that goal is determined by market forces.7Thus, compliance carbon markets place an emphasis on environmental certainty. Carbon taxes, on the other hand, provide certainty about the costs of compliance and creates stable prices, but the ensuing GHG reductions are not predetermined and are driven by market forces.7 Because of this, carbon taxes can be considered a cost certainty approach.

Sources

- World Bank. (2021). Carbon Pricing Dashboard. Retrieved from https://carbonpricingdashboard.worldbank.org

- United Nations Framework Convention on Climate Change. (n.d). Glossary. Retrieved from https://unfccc.int/fr/processus-et-reunions/la-convention/lexique-des-changements-climatiques-acronymes-et-termes

- Goodward J., Kelly A. (2010). Bottom Line on Offsets. World Resources Institute. Retrieved from https://www.wri.org/research/bottom-line-offsets

- Kenton, W. (2020). Cap and Trade. Investopedia. Retrieved from 4 https://www.investopedia.com/terms/c/cap-and-trade.asp

- Kaufman, N. (2016). Carbon Tax vs. Cap-and-Trade: What’s a Better Policy to Cut Emissions? World Resources Institute. Retrieved from https://www.wri.org/insights/carbon-tax-vs-cap-and-trade-whats-better-policy-cut-emissions 5

- Center for Climate and Energy Solutions. (n.d). Carbon Tax Basics. Retrieved from https://www.c2es.org/content/carbon-tax-basics/ 6

- Center for Climate and Energy Solutions. (2009). Cap and Trade vs. Taxes. Retrieved from https://www.c2es.org/document/cap-and-trade-vs-taxes/

- Rosenberg J., Toder, E., & Lu C. (2018). Distributional Implications of a Carbon Tax. Urban-Brookings Tax Policy Center. Retrieved from https://www.taxpolicycenter.org/sites/default/files/publication/155473/distributional_implications_of_a_carbon_tax_5.pdf

Click here to download this piece.

Print

Print Email

Email