How do I complete an Annual Financial Summary Report?

The Annual Financial Summary Report documents the financial activities of a 4-H group during the 4-H program year. Here’s an overview of the steps to completing the report.

This is the second of two articles about the Annual Financial Summary Report, an important document in the financial paperwork of a 4-H group. The report provides an open, auditable, public record; it is a wise fiscal practice. “What is an Annual Financial Summary Report?” addresses what the report is, why it is required and who needs to complete it. This second article provides an overview of the instructions for completing the report.

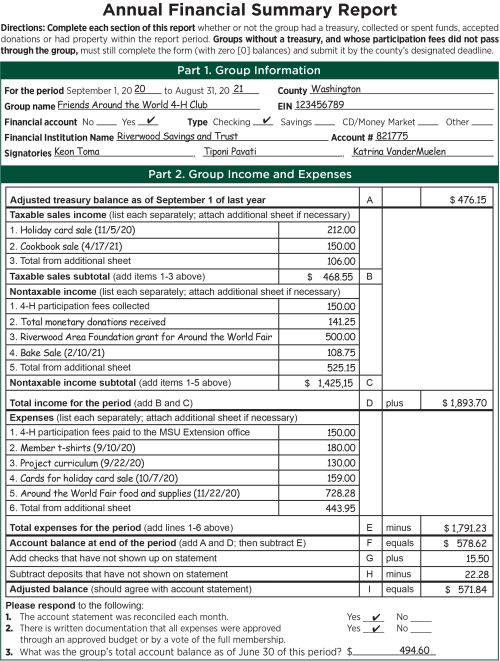

Part 1 of the Annual Financial Summary Report requests information about the group including its name, employer identification number, details about the account the group may have at a financial institution and the signers on that account. This information provides transparency regarding the group’s financial business.

Part 2 records the income and expenses over the 4-H program year of Sept. 1 through Aug. 31.

Starting with the adjusted treasury balance at the beginning of the year, taxable sales are listed next. Taxable sales include the income the group earned by selling tangible personal property; the name of the event or activity should be listed, the date and the total amount raised. Nontaxable sales income is listed separately; this separation will be critical to completing Part 3 of the form. 4-H participation fees that are handled by the 4-H volunteer are listed here along with any monetary donations, group dues, grants, income from services and other nontaxable income. Total the amount of income received.

Expenses are itemized next. 4-H participation fees paid to the Michigan State University Extension office are listed first, followed by the expenses incurred by the group, monetary prizes the group may have awarded and state sales tax paid with the previous year’s Annual Financial Summary Report. Total the amount of expenses.

Since there may be checks and deposits that have not yet cleared the account, the report then provides space to reconcile the report with the account statement. Once the math in Part 2 is computed, the report should agree with the account statement.

Next, the treasurer or volunteer completing the form is asked three questions: 1) To identify if the account statement was reconciled each month; 2) To identify if all expenses were approved through an approved budget or by a vote of the full membership; 3) To identify what the group’s total account balance was on June 30 of the programming year. This last piece of information is used in a required financial report to MSU that is completed annually by county 4-H staff.

The computation in Part 3 determines the amount of state sales tax due by any group that had taxable sales in Part 1.

Part 4 is to be completed only by those 4-H groups who do not have an account at a financial institution. The treasurer or volunteer who signs Part 4 is verifying the group had less than $100 in its treasury for more than 30 days over the program year.

Part 5 allows the group to list all non-consumable items purchased with 4-H group funds as well as items donated to the group. The chart identifies when the item was purchased or donated, its value and where it is being stored. This inventory is a helpful way to keep track of what the 4-H group owns.

The person completing the report must sign and date Part 6; another individual who reviews and approves the report must also sign the form.

The completed Annual Financial Summary Report, along with a copy of the treasurer’s report and secretary’s minutes, must be sent to the MSU Extension office. Once the Annual Financial Summary Report is reviewed by the 4-H program coordinator, they will sign and date the form, which then becomes a permanent part of the 4-H group’s file.

Since the Annual Financial Summary Report keeps track of public money raised in the name of 4-H, it is crucial for all group leaders to understand the significance of this document. Two publications, “Financial Manual for 4-H Volunteers: Leading the Way to Financial Accountability” and “Financial Manual for 4-H Treasurers: Managing Money Wisely,” provide guidance when completing the Annual Financial Summary Report. Both documents include a blank copy of the Annual Financial Summary Report, step-by-step instructions and a sample completed copy.

Since the Annual Financial Summary Report keeps track of public money raised in the name of 4-H, it is crucial for all group leaders to understand the significance of this document. Two publications, “Financial Manual for 4-H Volunteers: Leading the Way to Financial Accountability” and “Financial Manual for 4-H Treasurers: Managing Money Wisely,” provide guidance when completing the Annual Financial Summary Report. Both documents include a blank copy of the Annual Financial Summary Report, step-by-step instructions and a sample completed copy.

Michigan 4-H Youth Development prepares young people for successful futures. As a result of career exploration and workforce preparation activities, thousands of Michigan youth are better equipped to make important decisions about their professional future, ready to contribute to the workforce and able to take fiscal responsibility in their personal lives. To learn about the positive impact of Michigan 4-H youth career preparation, money management and entrepreneurship programs, read the 2015 Impact Report: “Preparing Michigan Youth for Future Careers and Employment.”

Print

Print Email

Email